Launch Automated Marketing Campaigns

Imagine a marketing platform that does the work of generating leads for you. Imagine spending just minutes selecting impactful content, and letting your powerful marketing engine contact your clients and prospects throughout the weeks and months to follow.

With the release of automated campaigns to Advisor Branded Marketing, subscribers don’t have to imagine.

You’ll be able to schedule and launch a targeted series of content in just a few clicks and eliminate the manual task of following up with new contacts to nurture and convert them.

Here’s How it Works

Pick a Campaign

Choose from a list of targeted campaigns to reach niche markets. Campaigns are designed to resonate with most common client segments including women, clients with children, Baby Boomers, business owners, and more.

Review Your Content

All the content for each campaign is ready-made, so all you need to do is look it over. Share content as is or personalize items with your own messaging.

Launch Your Campaign

Schedule your campaign and let the automation do the rest. Once a lead is ready to talk, you’ll receive a notification to schedule the first meeting.

What’s Included in Each Campaign Kit?

- Ready-made social posts and emails to promote the campaign and drive traffic to the campaign landing page.

- A customizable landing page with an engaging video to increase conversions and an easy-to-complete form to capture new contacts.

- Follow-up emails and relevant content to nurture and convert leads.

What Are the Other Enhancements?

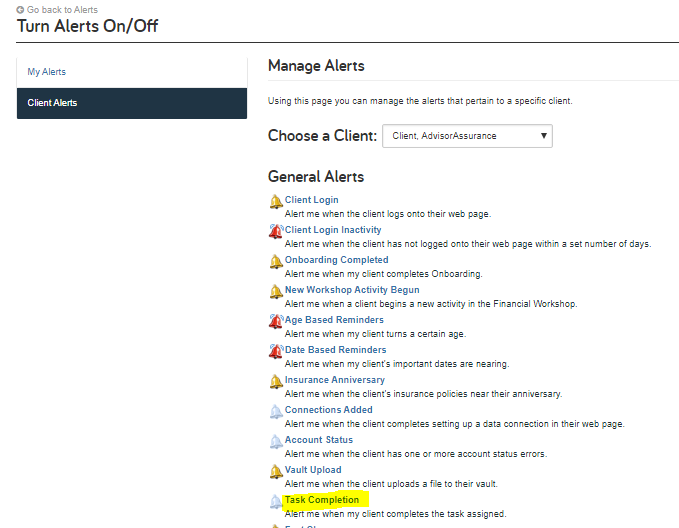

New Marketing Dashboard and Workflow

As part of this release, the marketing dashboard has been redesigned as a command center. So you can quickly see featured content, easily navigate to favorited content, or launch and manage automated campaigns. As part of this update, all campaign content has been added to the Content Library.

Interested in learning more about Advisor Branded Marketing and the new automated marketing campaigns? Sign up for a demo today.

Decision Center: Distribution Center Reports

As part of our strategic vision to provide planning solutions at every stage of the client lifecycle, we’re focusing our attention on the Decision Center experience as the core interactive planning experience within eMoney.

Decision Center is already designed to help you illustrate to clients the impact of their decisions with a click of a button. Over the last year we’ve begun to build out these capabilities to provide you more more seamless, interactive, and engaging experience.

Now, we’re adding our interactive estate planning reports to the Decision Center. You’ll be able to simplify your workflow and easily transition from cash flow to estate planning conversations in one place.

Watch this video on the future of the eMoney Planning experience to learn more about our long-term vision.

What does this update look like today?

Our interactive estate planning reports are now available within the Decision Center, providing you streamlined access and removing the need to switch back and forth between the Decision Center and Distribution Center.

Here’s how it works

To access these reports, open Decision Center and click on the Selected Report drop-down menu. Then click Estate Planning to launch the reports.

Once selected you can easily switch your view between Estate Flow Charts, Compare Distributions, and Compare Survivor Income with the Viewing drop-down menu.

Note: These interactive reports are still available within Distribution Center

Stay tuned for more enhancements to Decision Center this year as we begin to unify the full breadth and depth of eMoney’s planning capabilities.

Decision Center: Expenses and Other Income Charts

The Cash Flow Overview the Decision Center allows you to demonstrate the relationship between a client’s expenses and the sources used to fund those expenses on a year by year basis.

Building on our strategic vision to provide a more seamless, interactive, and intelligent planning experience, the addition of the new Expenses and Other Income charts in the Cash Flow Overview enables you to gain more transparency into the details of a client’s cash flow, and have even more collaborative and engaging conversations with clients.

As we continue to focus our attention on making the Decision Center your core planning experience, our goal is to enable you to provide your clients with immediate transparency into any topic and over any time frame, helping to maximize both client engagement and advisor efficiency.

Where can I access the Expenses and Other Income Charts?

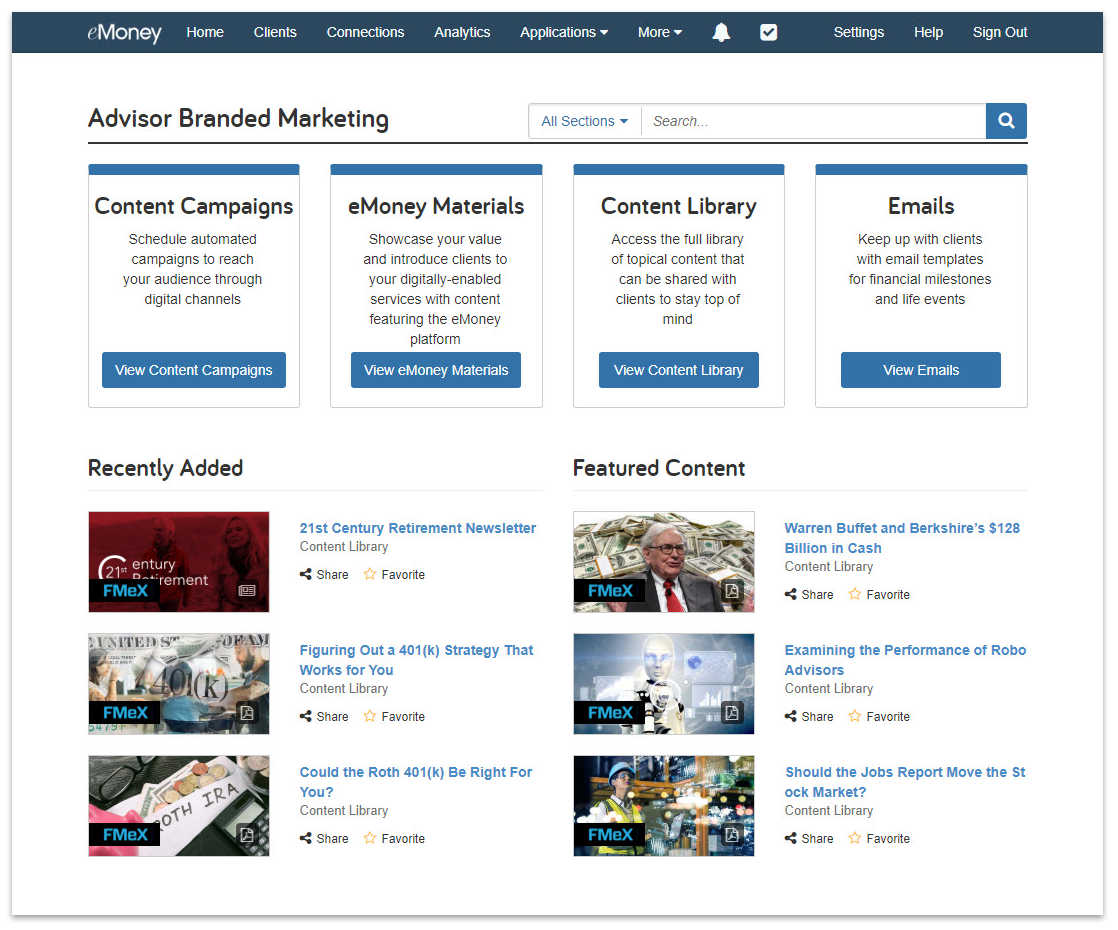

Go to Decision Center and select the Cash Flow report then click Viewing to open the drop-down menu. Here you’ll see two new options: Expenses and Other Income.

Expenses Chart

It provides an in-depth look into your clients’ expenses through an interactive and modern experience, broken up by the following categories:

- Living Expenses

- Healthcare

- Insurance Premiums

- Other goals/expenses

- Taxes

Other Income Chart

It provides an in-depth look into your clients’ other income through an interactive and modern experience, broken up by the following categories:

- Deferred Income

- Annuity Income

- Miscellaneous Income

- Distributions and Proceeds

- Insurance Benefits

Stay tuned for even more enhancements including the addition of more cash flow drill-downs and check out our latest release on moving our interactive Estate Planning reports into the Decision Center.

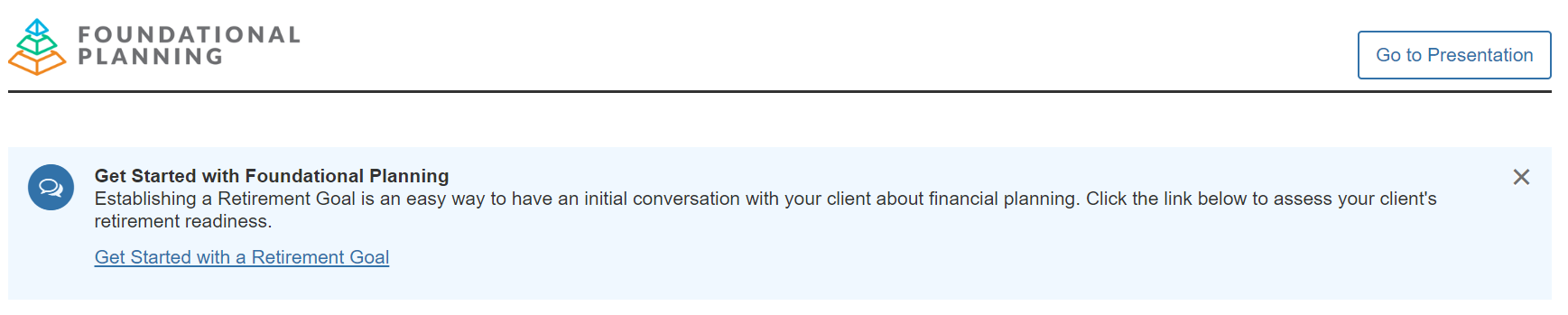

Foundational Planning: Quick Path to a Starter Retirement Analysis

Foundational Planning streamlines the planning process so advisors can collaborate with clients on their life and wealth goals.

Our latest enhancements are designed to help advisors get started with a retirement planning conversation. To continue to streamline the experience, we’ve added targeted, data-driven messages on the Foundational Planning overview page to guide advisors through the retirement planning experience.

Based on the amount of client information available, a message will appear to facilitate the creation of starter retirement plans for clients and prospects.

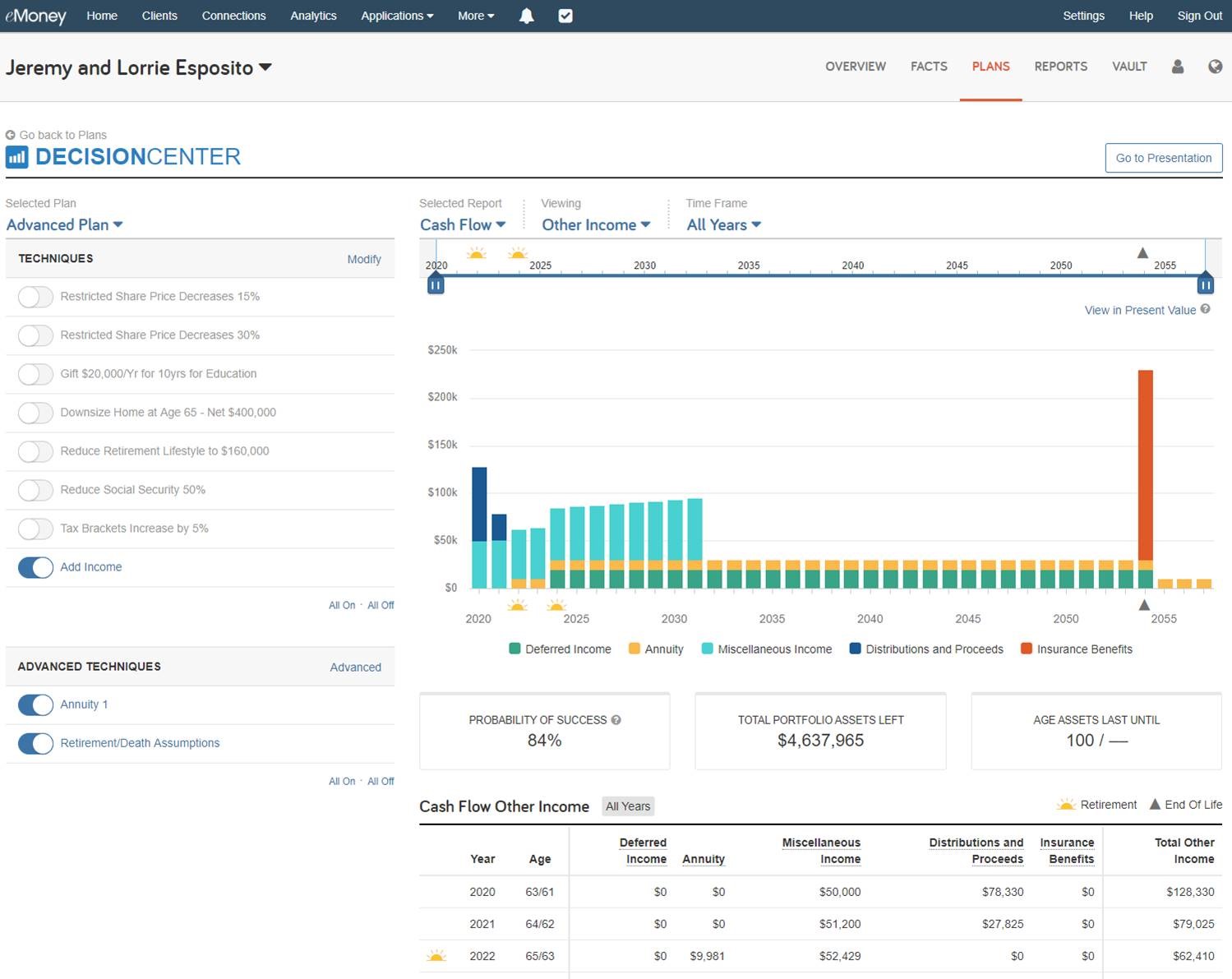

Alerts: Task Completion

Now available, an alert for advisors that enables them to get notified when the client completes a task that was assigned to them.