MODIFY ADVANCES TECHNIQUES IN DECISION CENTER

Rename, Reorder, and Remove Advanced Techniques within Decision Center and Advanced Planning

Based on your feedback, we’ve added the ability to rename, reorder, and delete Advanced Techniques from within Decision Center and Advanced Planning.

By renaming and reordering techniques, you can arrange Techniques to create a more compelling story to show your clients; with even more clarity into what’s changing in each Technique.

In addition, the ability to delete advanced techniques within Decision Center streamlines your workflow, enabling you to update plans live as your client conversations evolve.

How can I modify Technique names in Decision Center?

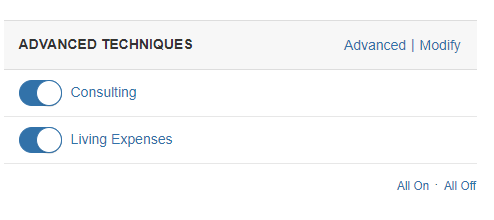

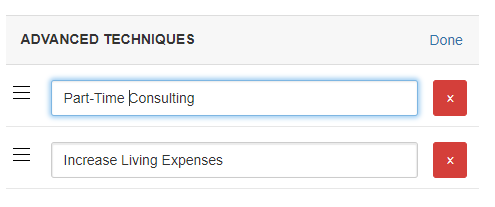

When you add Advanced Techniques to Decision Center, you will find a new Modify option.

Select Modify to rename, reorder, and delete from Decision Center.

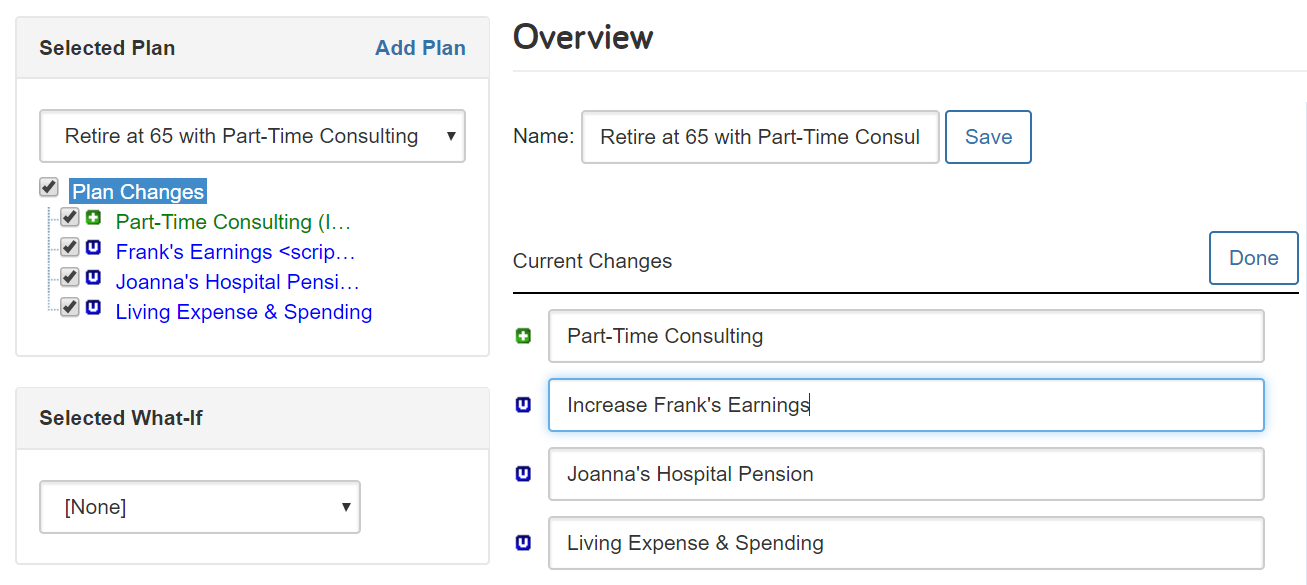

How can I modify Technique names in Advanced Planning?

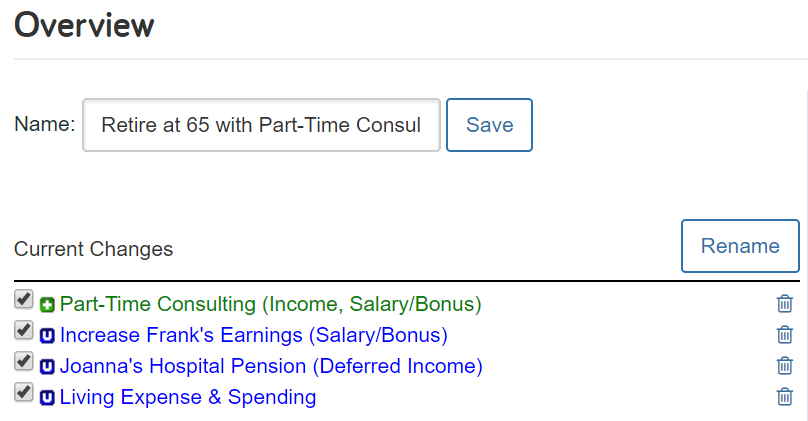

Click the Rename button from the Plan Overview in Advanced Planning to rename your Current Changes / Techniques.

Stay tuned for more enhancements to the Decision Center as we begin to unify the full breadth and depth of eMoney’s planning capabilities.

INDEX LEAVE TO HEIRS AMOUNT (DESIRED REMAINDER)

CARES ACT UPDATES

The Coronavirus Aid, Relief and Economic Security (CARES) Act is intended to keep businesses and individuals afloat during this unprecedented time. While this legislation addresses many problems arising from the pandemic, there are several ways that the new bill could impact the way advisors interact with both their financial planning software and their current clients, including:

-

Individuals and married couples will be eligible for a stimulus check based on their income. They will also receive an additional $500 for every child under 17.

-

The 10% tax penalty on premature distributions of up to $100,000 from qualified retirement accounts has been waived for 2020 for “coronavirus-related” purposes.

-

RMDs are waived for certain retirement plans and IRAs for 2020.

-

For those taxpayers who do not itemize deductions (only about 10% of taxpayers itemized in 2018), they may deduct up to $300 of charitable contributions which will be an above the line deduction.

-

The 60% AGI limit on gifts to public charities is increased to 100% of AGI for 2020.

How eMoney is Supporting the CARES Act Changes

RMDs are waived for certain retirement plans and IRAs for 2020.

This change applies to everyone—not just those affected financially by coronavirus illnesses. We updated our system on April 7, 2020 to reflect this change.

Note: This may result in small changes to plan results for clients who are currently receiving RMDs.

The 60% AGI limit on gifts to public charities is increased to 100% of AGI for 2020.

All carryforward rules apply as normal. We updated our system on April 21, 2020 to reflect this change.

Note: this may result in small changes to plan results for clients who have gifts to public charities in 2020.

The 10% penalty tax on premature withdrawals being waived in 2020.

Only for withdrawals related to coronavirus-related reasons.

Note: We already support this function. Advisors can create a transfer flow and choose “exempt from penalty tax” in the transfers area.

Spread the regular tax on a coronavirus related premature withdrawal over three years.

Only for withdrawals related to coronavirus-related reasons. We already support this function. Advisors can use the Tax Adjustments area to reduce the 2020 tax estimate and increase the tax estimate in 2021 and 2022.

Note: The amount of the adjustment needed is determined by advisor.

$300 charitable deduction.

For taxpayers who do not itemize deductions (only about 10% of taxpayers itemized in 2018), they may deduct up to $300 of charitable contributions, which will be an above the line deduction. This applies to years beyond 2020.

Note: We already support this function. Advisors can add a $300 above line deduction in the Tax Adjustments area.

As your clients during the COVID-19 pandemic, check out our latest webinar series, Insights and Best Practices for Planning During Times of Disruption.

And make sure to save your seat for this month’s continuing education webinar, Planning Opportunities in Today’s Changing Regulatory and Market Environments (1 Credit). In this session we’ll review recent legislation related to the SECURE Act and CARES Act, and their incorporation into eMoney’s financial planning software.

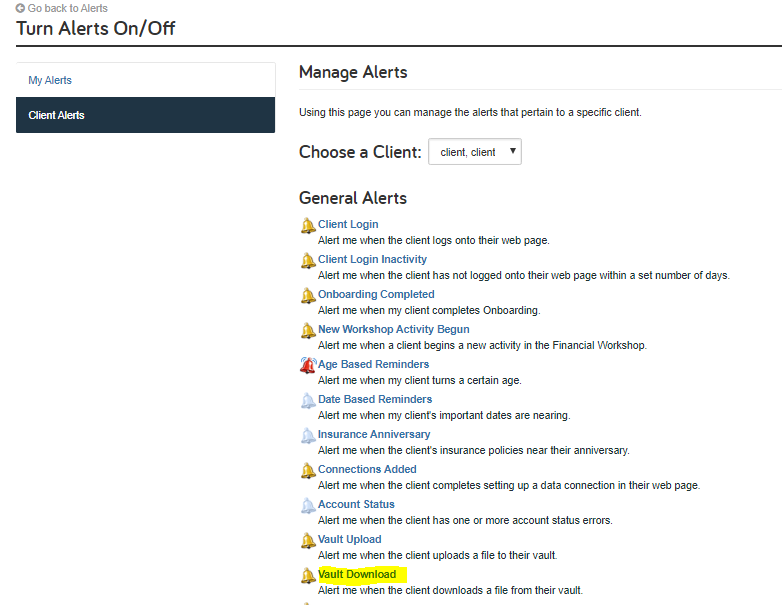

VAULT DOWNLOAD ALERT

With the new Vault Download alert it’s easier than ever to stay informed of your client’s actions. The Vault Download alert notifies you as soon as your client views and downloads any important documents, presentations, or files from their Vault, without the need to follow-up via phone or email.

By staying informed of client Vault downloads, you can save time and provide a better experience for your clients.

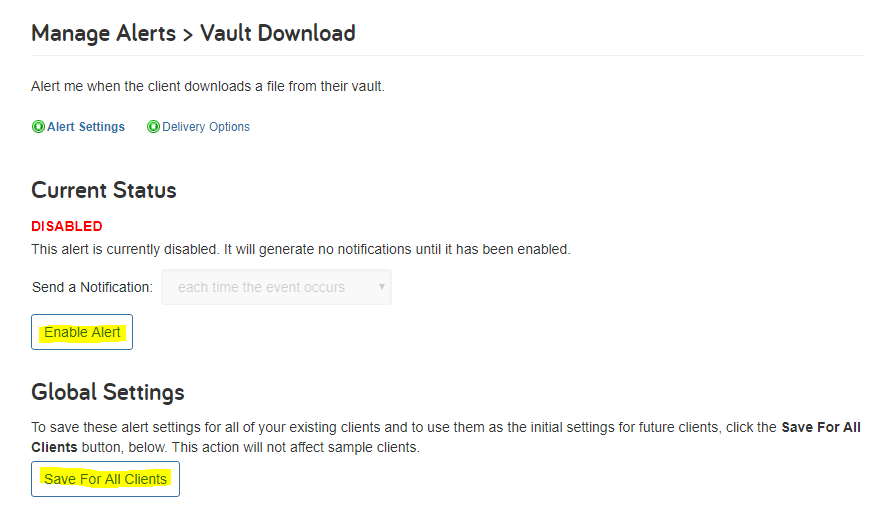

How do I enable the Alert?

Click on the Alerts icon on your Navigation bar and select Manage.

The new Vault Upload alert is available under Client Alerts.

Click into the alert and select Enable Alert to enable the alert for the chosen client or for all clients with the Save for all clients button.

Stay tuned for more updates coming next month!

By popular demand, we’ve added the ability to index the desired remaining amount of portfolio assets at death.

The Desired Remainder Amount in Advanced Planning and Leave to Heirs Amount in Foundational Planning can now be assigned to specify a static rate at which this dollar amount should grow.

You can control the Leave to Heirs amount through the Basic Fact Finder under Goals.

Or through the Advanced Fact Finder under your Assumptions > Miscellaneous > Simulation settings.

The Miscellaneous Assumptions can also be updated on an account level by going to Advisor Settings > Fact Defaults > Assumptions – Misc > Simulation.

Pro-Tip: The default index rate is 0% which will show no change in the value from previous behavior.

In addition, Minimum Asset Level for Solving Purposes in Advanced Facts has been renamed to Desired Remainder Amount to align with Advanced Planning.